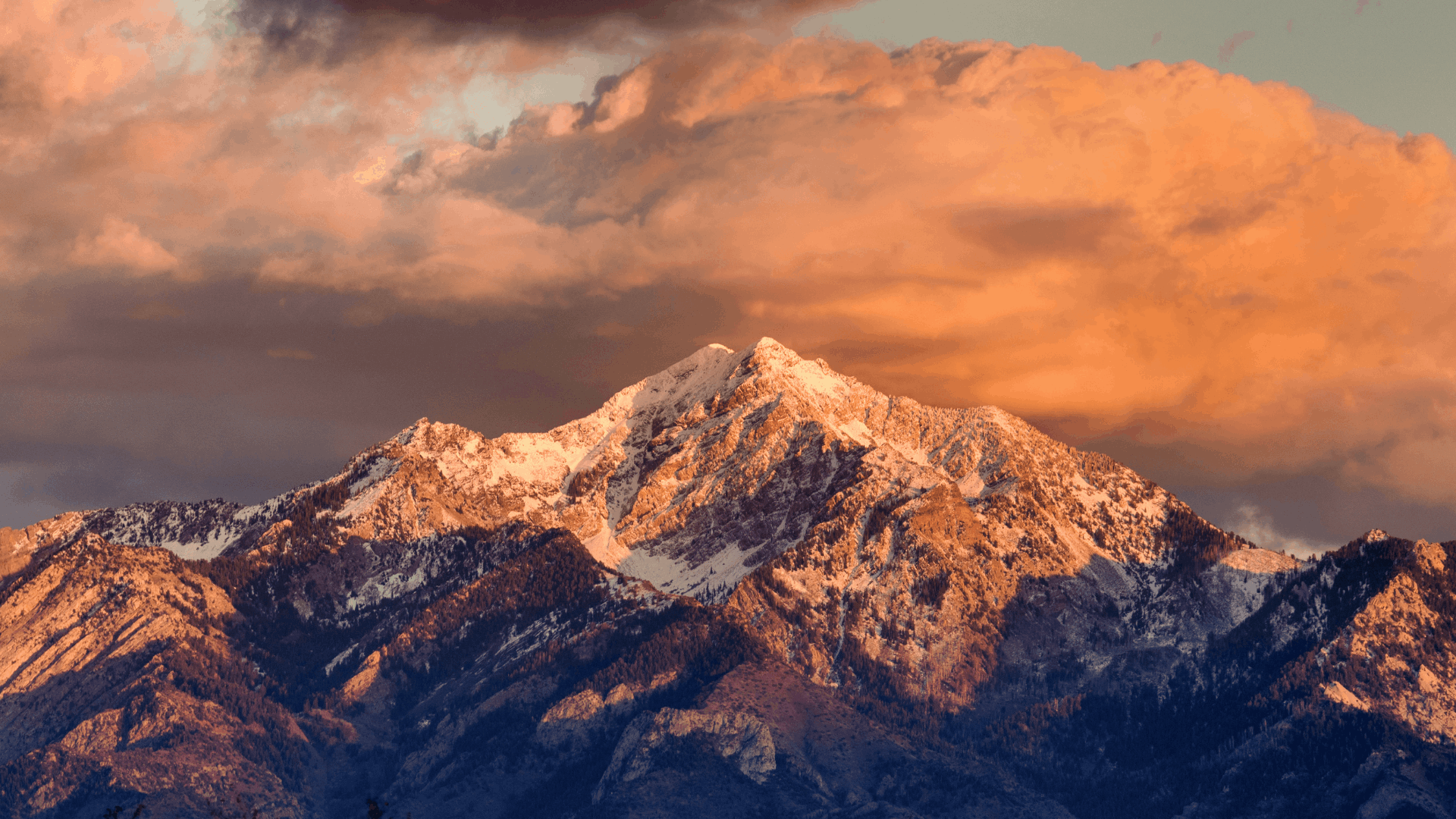

Brook & Lee's Market Report | Wasatch Front | Q3 2025

Utah Housing at a Glance

Across the Wasatch Front, the third quarter of 2025 revealed a market finding its balance. Inventory crept upward, time-to-sell stretched slightly, and price growth began to moderate—yet demand remained steady for homes that showed well and were priced realistically.

- Median sales price held between $430K–$555K depending on county.

- Days on market averaged 50–65 days, up modestly year-over-year.

- Months of supply hovered between 3½–4 months, signaling a market still leaning toward sellers but trending toward equilibrium.

In short: Utah real estate is normalizing, not crashing. Well-positioned buyers and sellers both have opportunities heading into Q4.

What It Means for You

For Buyers

A touch more breathing room has returned. With months of supply near 4 and sellers offering rate buydowns or concessions, well-prepared buyers can negotiate again. Focus on turnkey homes within budget, and lock financing early to hedge against rate fluctuations.

For Sellers

The “list-it-and-it-sells-overnight” era is behind us. Today’s buyers expect value, presentation, and flexibility. Price to current conditions, invest in small cosmetic improvements, and aim to be the best option in your segment—not just another listing.

For Investors

Stabilizing prices and longer DOM create a window to acquire rentals or flips at fair value before demand rebounds in 2026. Look for solid cash-flow potential in Weber and Utah Counties, where entry points remain lower but fundamentals are improving.

County by County

Salt Lake County

Median $555K (+3.1% YoY). Steady appreciation and strong absorption indicate buyers remain active in core neighborhoods.

Utah County

Median $498.9K (-2.5% YoY). More listings and longer market times are giving buyers leverage on newer construction and resale homes alike.

Davis County

Median $541K (+4.5% YoY). Healthy growth with moderate inventory; demand strongest for move-in-ready properties under $600K.

Weber County

Median $430K (-2.0% YoY). Affordability continues to attract first-time buyers and investors despite slight price softening.

Brook & Lee Insight

While national headlines still focus on mortgage rates, Utah’s fundamentals remain strong: population growth, high household incomes, and limited long-term housing supply.

Our Take: Q3 2025 marked the transition from a reactive market to a rational one. Strategy now matters more than speed.

- Buyers: Use this moment to secure quality assets before rates fall and competition returns.

- Sellers: Showcase condition and lifestyle value; the right presentation still commands a premium.

- Investors: Focus on neighborhoods with employment anchors and rental stability—Salt Lake’s west bench, the Lehi–Eagle Mountain corridor, and Ogden’s east side stand out.

Looking Ahead to Q4 2025…

Expect a quieter but steadier fall. As inventory plateaus and rates show signs of easing, motivated buyers will step back in before the new year. Those who move with clarity and preparation will continue to win—because in real estate, intentional decisions always outperform impulsive ones.

Data © UtahRealEstate.com & Utah Association of Realtors®. Information deemed reliable but not guaranteed. Presented by Brook & Lee Real Estate, brokered by Real Broker, LLC. Equal Housing Opportunity.

Categories

Recent Posts